oklahoma franchise tax due date 2021

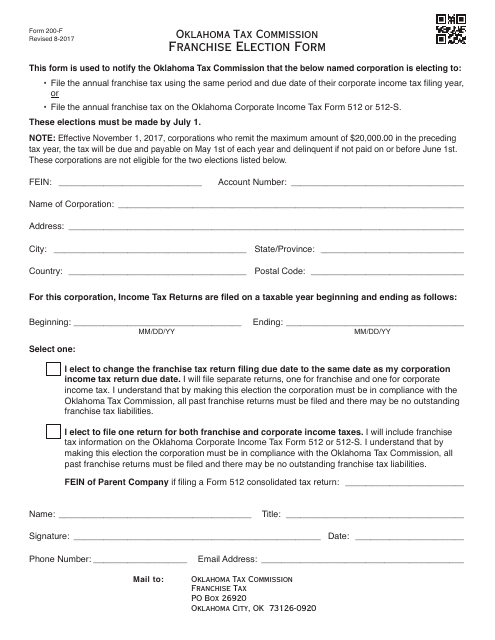

For these corporations franchise tax is due and payable on May 1 of each year and delinquent if not paid on or before June 1. The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200.

What Is Franchise Tax Overview Who Pays It More

Thank you for contacting us.

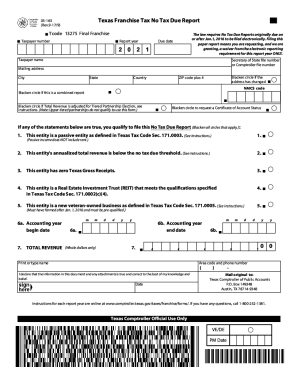

. Any taxpayer with a payment due by March 15 2021 andor April 15 2021 for 2020 Oklahoma income taxes andor any estimated 2021 income tax payment due by March 15 2021 andor April 15 2021 is granted a waiver of any penalties andor interest for payments not received by June 15 2021 Any taxpayer with an Oklahoma franchise tax return obligation will. Tax period ending and due dates for quarterly filers quarter end 03-31 -2021 06 -30-2121 0 due date 04 30 2021 08 02 2021 quarter end due 09-30-2021 12-31-2021 date 11 -01 2021 1-3 2022 rev. Final Franchise Tax Reports Before getting a Certificate of Account Status to terminate convert merge or withdraw registration with the Texas Secretary of State.

See page 16 for methods of contacting the Oklahoma Tax Commission. Due Dates Annual Franchise Tax Reports The annual franchise tax report is due May 15. Interest at the rate of 125 per month shall be paid on the tax due from the original due date until paid.

2022 texas franchise tax report information and instructions pdf no tax due. These corporations are not eligible for the two elections listed below. T o avoid a.

What is Oklahomas Franchise Tax. Delaware LLCs LLPs and LPs your Franchise Tax is due Saturday June 1 2021. 2021 Form 511 Oklahoma Resident Individual Income Tax Forms Packet Instructions State of Oklahoma.

Form 200-F Revised 9-2021. See directions on the form. Tax Deadline 2022 Oklahoma.

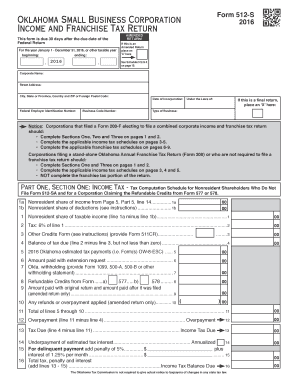

Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax Form 512-FT-SUP Supplemental Schedule for Form 512-FT Filing date. Supplemental Schedule for Form 512-S Part 5 Form 512-SA. Your Oklahoma return is due 30 days after the due date of your federal return.

Any taxpayer with an Oklahoma franchise tax liability due and payable on or before July 1 2021 will be granted a waiver of any penalties andor interest for returns filed by August 1 2021 provided payment is received by September 15 2021. Nonresident Shareholder Agreement Income Tax Form. The report and tax will be delinquent if not paid on or before September 15.

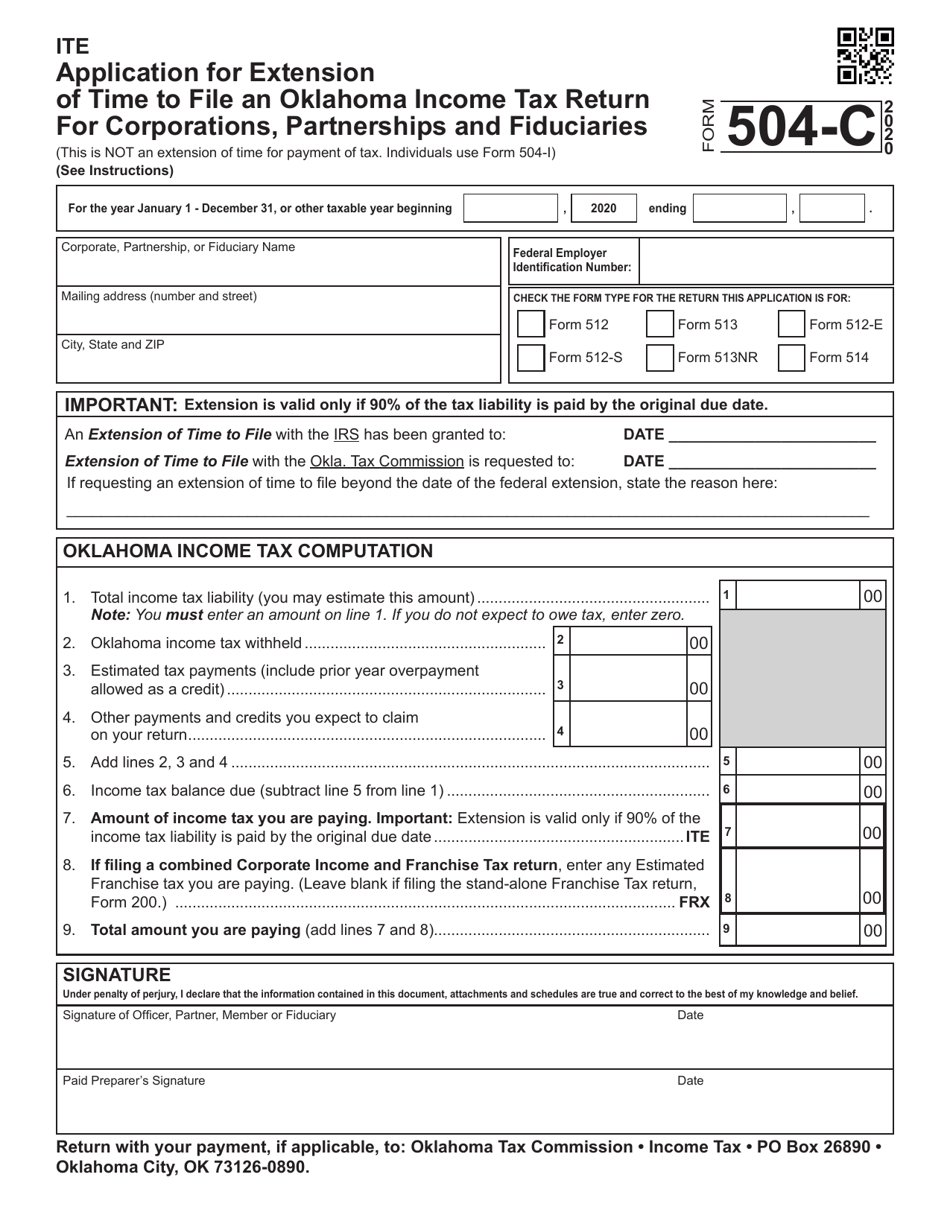

See page 4 for information regarding extended. Mail Form 504-C Application for Extension of Time to File an Oklahoma Income Tax Return for Corporations Partner-ships and Fiduciaries with payment if applicable to. Oklahoma Annual Franchise Tax Return State of Oklahoma.

The Oklahoma franchise tax is due by July 1st each year. 2022 tax filing deadline for oklahoma 2022 tax filing deadline for oklahoma. OK tax return filing and payment due date for Tax Year 2021 is April 18 2022Oklahoma State Individual Taxes for Tax Year 2021 January 1 - Dec.

Pursuant to OAC 71050-17-1 the Oklahoma Corporation Income and Franchise Tax Return must be filed electronically. 2021 Oklahoma Small Business Corporation Income and Franchise Tax Forms and Instructions This packet contains. A ten percent 10 penalty and one and one-fourth percent 125 interest per month is due on payments made after the due date.

Franchise Tax Board - GIG ECONOMY 2021. Interest at the rate of 125 per month shall be paid on the tax due from the original due date until paid. 90 of the tax.

31 2021 can be prepared and e-Filed now with an IRS or Federal Individual Tax Return or you can learn how to complete and file only an OK state returnFind IRS or Federal Tax Return deadline details. Small Business Corporation Income Tax form Form 512-S-SUP. Delaware LLC Franchise Tax Due Tuesday June 1 2021.

2019 Oklahoma Corporation Income and Franchise Tax Forms State of Oklahoma 2021 Form 514 Oklahoma Partnership Income Tax Return Packet Instructions State of Oklahoma. Oklahoma Home current Find Courses. For assistance or forms.

Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form Form 200-F has been filed. Any taxpayer with a payment due by March 15 2021 andor April 15 2021 for 2020 Oklahoma income taxes andor any estimated 2021 income tax payment due by March 15 2021 andor April 15 2021 is. 2021 Payroll in Excel- Oklahoma Withholding Edition.

Registrants can change their entitys tax filing date to the same schedule of filing as their corporate income and franchise taxes. Return and Payment Due Dates. Income reports and tax payment must be received by the fifteenth 15 day of the third month from the end of the corporations income tax year.

File your return by the same due date as your federal income tax return. See page 16 for methods of contacting the Oklahoma Tax Commission OTC. However some states have different dates.

Effective November 1 2017 corporations who remit the maximum amount of 2000000 in the preceding tax year the tax will be due and payable on May 1st of each year and delinquent if not paid on or before June 1st. Your Oklahoma return is due 30 days after the due date of your federal return. 2020 Tax Payment Deadline Extension.

If a taxpayer computes the franchise tax due and determines that it amounts to 25000 or less the taxpayer is exempt from the tax and a no tax due form is required to be filed. Click here to return to home page. 2019 Oklahoma Corporation Income and Franchise Tax Forms State of Oklahoma 2021 Form 514 Oklahoma Partnership Income Tax Return Packet Instructions State of Oklahoma.

If a taxpayer computes the franchise tax due and determines that it amounts to 25000 or less the taxpayer is exempt from the tax and a no tax due form is required to be filed. Oklahoma Tax Commission PO Box 26890 Oklahoma City OK. Your message has been sent.

For The Year 2021 S Corp Tax Returns Are Due On March 15Th 2022. Instructions for completing Form 512-S Form 512-S. For these corporations franchise tax is due and payable on May 1 of each year and delinquent if not paid on or before June 1.

If May 15 falls on a weekend or holiday the due date will be the next business day.

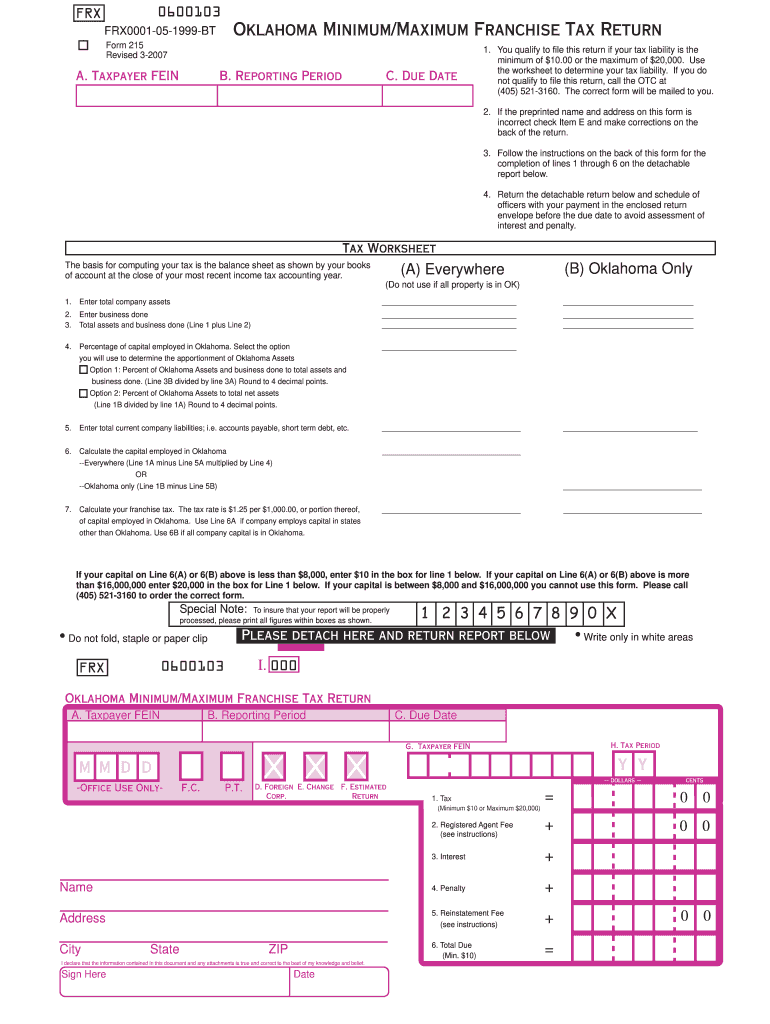

2007 2022 Form Ok Otc 215 Fill Online Printable Fillable Blank Pdffiller

Texas Franchise Tax No Tax Due Fill Out And Sign Printable Pdf Template Signnow

2020 Tax Deadline Extension What You Need To Know Taxact

Otc Form 200 F Download Fillable Pdf Or Fill Online Franchise Election Form Oklahoma Templateroller

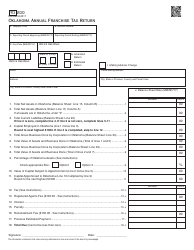

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

What Is Privilege Tax Types Rates Due Dates More

How Failing To File Franchise Tax Returns Causes Personal Liability Texas Tax Talk

Fillable Online Form 512 S Fax Email Print Pdffiller

Oklahoma Form 512 Corporate Income Tax Return Form And Schedules 2021 Oklahoma Taxformfinder

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

2007 2022 Form Ok Otc 215 Fill Online Printable Fillable Blank Pdffiller

Incorporate In Oklahoma Do Business The Right Way

Fill Free Fillable Forms For The State Of Oklahoma

2021 Federal State Tax Deadline Extension Update Picnic S Blog

Otc Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return 2020 Templateroller

Otc Form 504 C Download Fillable Pdf Or Fill Online Application For Extension Of Time To File An Oklahoma Income Tax Return For Corporations Partnerships And Fiduciaries 2020 Templateroller

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller